Basically I think the following ten points about oil and gas production are correct. The relatively new process of combining horizontal drilling to provide much greater access to oil and gas reservoirs, combined with multi-stage hydraulic fracturing to enhance flow rates is, as they say, a dramatic "game changer" in America's quest for energy independence.

It is not just the technology that makes this so exciting. From this geologists perspective, what is really significant is this production is coming from organic-rich shales, arguably the most abundant sedimentary rock type on Earth. Throw out all the old rules of exploration requiring source rock, maturation, migration, reservoir, structural trapping mechanism, and sealing rocks. It is much simpler now. What "Peak Oil"? It's a brand new ball game. Re-set the scoreboard, go long the drillers and oil field service companies. Gentlemen (and women), start your engines.

Peter

10 Points To Consider When Examining The U.S. Quest For Energy Independence

http://seekingalpha.com/article/384031-10-points-to-consider-when-examining-the-u-s-quest-for-energy-independence?source=email_macro_view&ifp=0

We are currently at a time when domestic gasoline and diesel prices follow global fundamentals rather than domestic supply / demand dynamics. We are also at a juncture where natural gas is set to either remain a domestic fuel or become a global piece of the puzzle through LNG exports. At this time of uncertainty, it is good to take a step back and review the facts and forecasts to consider whether the U.S. can become energy dependent, and even if it does, will prices still be dictated on a global scale?

1) Oil production in North Dakota, has surpassed that of Opec member Ecuador, and is set to become the second largest oil producing state in the U.S. this year, surpassing Alaska and California.

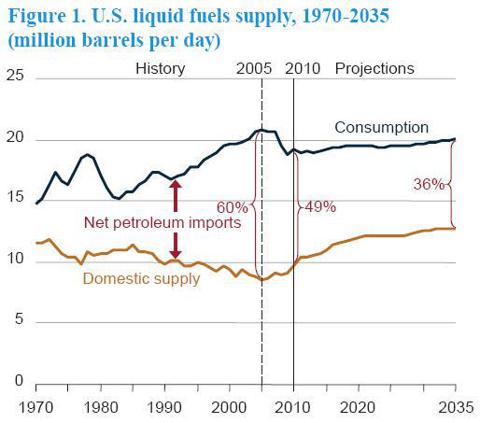

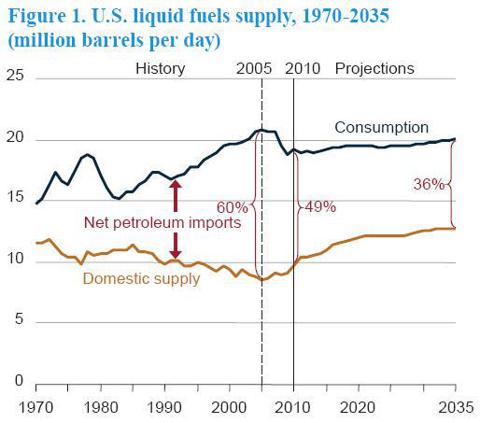

2) EIA states that U.S. oil imports in 2005 = 60% of total consumption, U.S. oil imports in 2010 = 49%, U.S. oil imports In 2035 =

36%.

(Click to expand)

he

3) Bentek states over the next five years the U.S. will see 75 oil pipeline expansions, 25 railroad expansions, and 7 refinery expansions

4) The new kids on the block in terms of shale plays over the next five years taking over from Bakken, Marcellus, and Eagle Ford include

Utica in Ohio,

Niobrara in Colorado, and

Monterey in California.

(Don't forget the father of them all, the Barnett Shale under me here in the Fort Worth Basin. Peter)

5) EIA slashed the estimate for Marcellus gas shale reserves in its latest 2012 outlook, from 410 Tcf to 141 Tcf.

6) This led to a huge write-down in total U.S. gas shale reserves from 827 Tcf in last year's report to 482 Tcf in the 2012 report

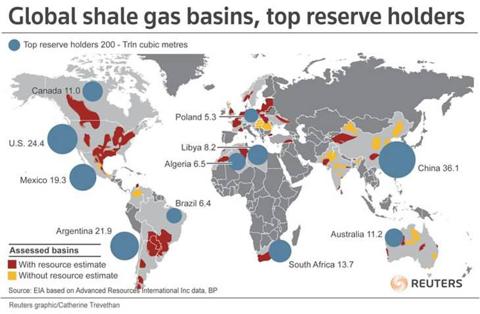

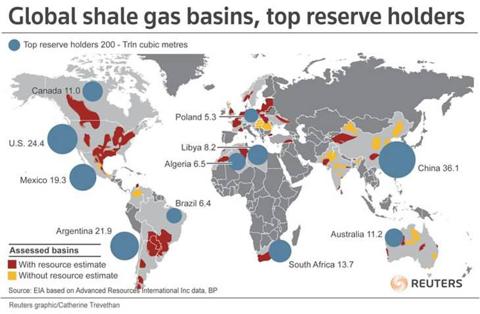

7) According to

Reuters / EIA, China is one of the largest holders of gas shale reserves at 1,275 Tcf

8) According to research by IHS CERA, 600k jobs have been created by shale in the U.S., with that set to reach 870k in 2015. This number is set to nearly double to 1.6mln by 2035. (Someone explain this to the Obama Administration quick.....please.)

8) According to research by IHS CERA, 600k jobs have been created by shale in the U.S., with that set to reach 870k in 2015. This number is set to nearly double to 1.6mln by 2035. (Someone explain this to the Obama Administration quick.....please.)

9) EIA is calling for shale to make up 49% of natural gas supply by 2035. IHS CERA is calling for this number to be more like 60%

10) EIA expects U.S. oil production to increase by 1.2mbd from 5.5mbpd in 2010 to 6.7mbpd in 2020. Bentek is somewhat more bullish, calling for an additional 2.2mbpd by 2016.

These 10 facts and stats all bode well for the U.S. (...even no.7, as multinational companies pump money into the U.S. / Canada to cut their teeth on joint ventures, before taking what they have learned and applying it globally). As for the downward revisions of estimates of natural gas reserves, they will continue to be revised up and down, but nevertheless new discoveries will be made.

It is impossible to predict whether prices will be dictated by global fundamentals in the future; all that can be said is that the U.S. is becoming increasing less reliant on other countries, and more reliant on itself. That has to be a good thing.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Matt Smith spent his twenties working in investment management in London, England, before swapping his bowler hat for a banjo and moving to Louisville, KY, and Summit Energy. Matt is a Commodity Analyst at Summit, and produces a number of pieces of research across a number of global commodities....

More